oklahoma auto sales tax rate

31 rows The state sales tax rate in Oklahoma is 4500. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad Valorem Exemption E-File Free File Businesses Tax Types.

What S The Car Sales Tax In Each State Find The Best Car Price

Excise tax is assessed upon each transfer of vehicle all terrain vehicle boat or outboard motor ownership unless specifically exempted by law.

. Oklahoma State Sales Tax. Effective May 1 1990 the State of Oklahoma Tax Rate is 45. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana 1145 and Arkansas 1125.

Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. What is the sales tax in Oklahoma 2021. There are special tax rates and conditions for used vehicles which we will cover later.

For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter. Excise tax is collected at the time of issuance of the new Oklahoma title. 608 rows 8742 Oklahoma has state sales tax of 45 and allows local governments to.

Did South Dakota v. Counties and cities can charge an additional local sales tax of up to 65 for a maximum possible combined sales tax of 11 Oklahoma has 762 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Used boats and boat motors.

How to Calculate Oklahoma Sales Tax on a New Car. Select the Oklahoma city from the list of popular cities below to see its current sales tax rate. Taxpayers pay an excise tax of 325 percent of the price when they buy a new vehicle and a lower tax rate on used vehicles depending on the sales price.

This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. 20 on the first 1500 plus 325 percent on the remainder. Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933.

Maximum Possible Sales Tax. Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way.

Search Vehicle Tax Oklahoma. The minimum combined 2022 sales tax rate for Yukon Oklahoma is. The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price.

Maximum Local Sales Tax. The 2018 United States Supreme Court decision in South Dakota v. Get Results On Find Info.

Average Local State Sales Tax. This means all new vehicle purchases are taxed at a flat combined rate of 45. 325 percent of the taxable value which.

Find your state below to determine the total cost of your new car including the car tax. New boats and boat motors. Registration fees are.

22300 for a 20000 purchase Boley OK. Oklahoma also has a vehicle excise tax as follows. Oklahoma has recent rate changes Thu Jul 01 2021.

The Motor Vehicle Excise Tax on a new vehicle sale is 325. There are a total of 356 local tax jurisdictions across the state collecting an average local tax of 3205. Taxes generally are paid to tag agents who are contracted by the Tax Commission as collection agents.

325 percent of the manufacturers original retail selling price. Printable PDF Oklahoma Sales Tax Datasheet. Excise tax is often included in the price of the product.

For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in Oklahoma. The Yukon sales tax rate is. Oklahoma has state sales tax of 45 and allows local governments to collect a local option sales tax of up to 65.

With local taxes the total sales tax rate is between 4500 and 11500. The annual registration fee for non-commercial vehicles ranges from 15 to 85 depending on the age of the vehicle. The excise tax is 3 ¼ percent of the value of a new vehicle.

In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle purchases. Ad Search Vehicle Tax Oklahoma. Wayfair Inc affect Oklahoma.

This is the total of state county and city sales tax rates. Just enter the five-digit zip code of the location in. The County sales tax rate is.

2021 List of Oklahoma Local Sales Tax Rates. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator. OK Sales Tax Calculator.

How Much Is the Car Sales Tax in Oklahoma. Oklahoma OK Sales Tax Rates by City The state sales tax rate in Oklahoma is 4500. Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees.

Oklahoma residents are subject to excise tax on vehicles all terrain. The value of a vehicle is its actual sales price. The cost for the first 1500 dollars is a flat 20 dollar fee.

The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. The Oklahoma sales tax rate is currently. Municipal governments in Oklahoma are also allowed to collect a local-option sales tax that ranges from 035 to 7 across the state with an average local tax of 4264 for a total of 8764.

325 percent of the purchase price. There is also an annual registration fee of 26 to 96 depending on the age of the vehicle.

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

State And Local Sales Tax Rates Midyear 2014 Tax Foundation

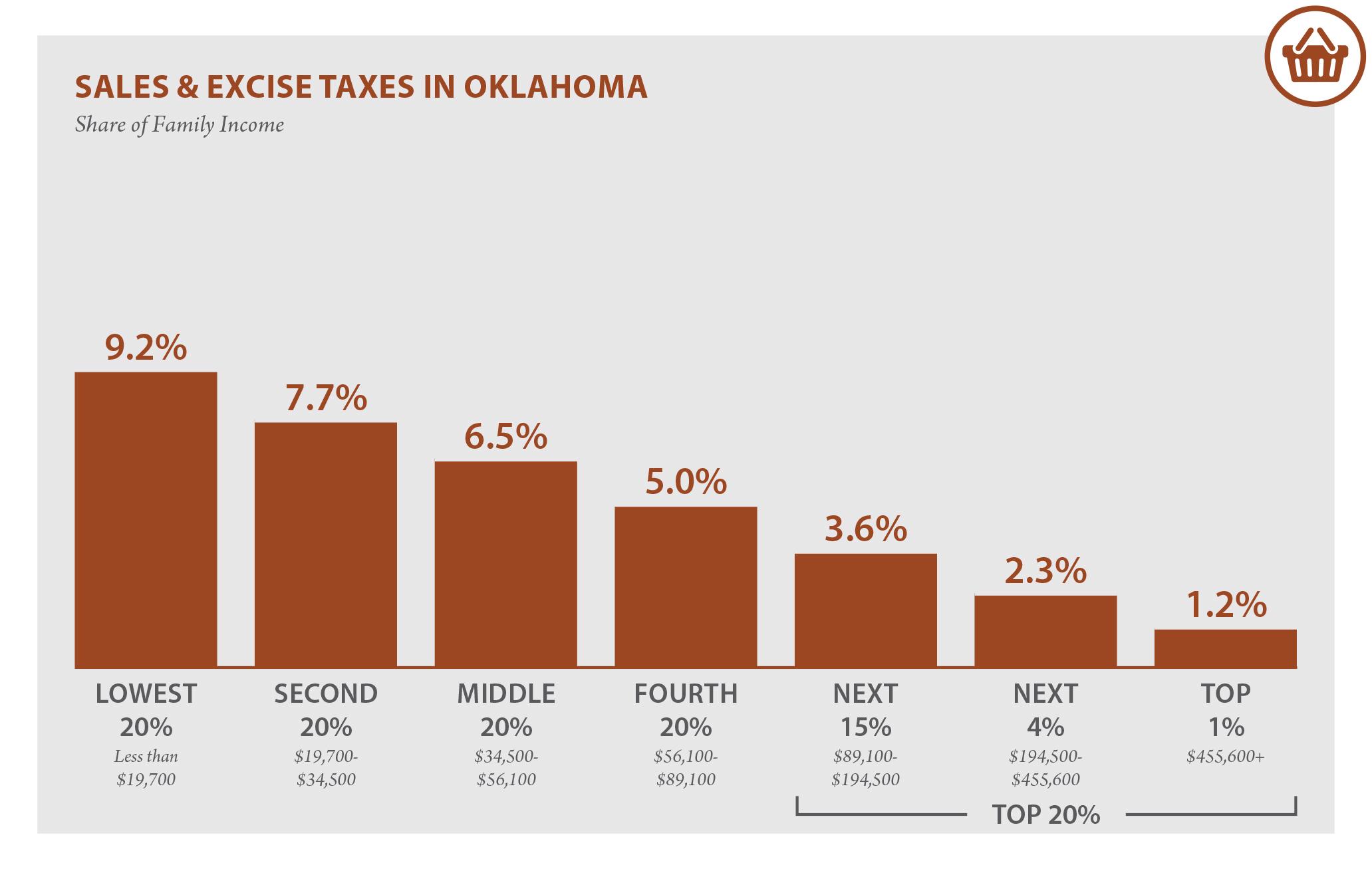

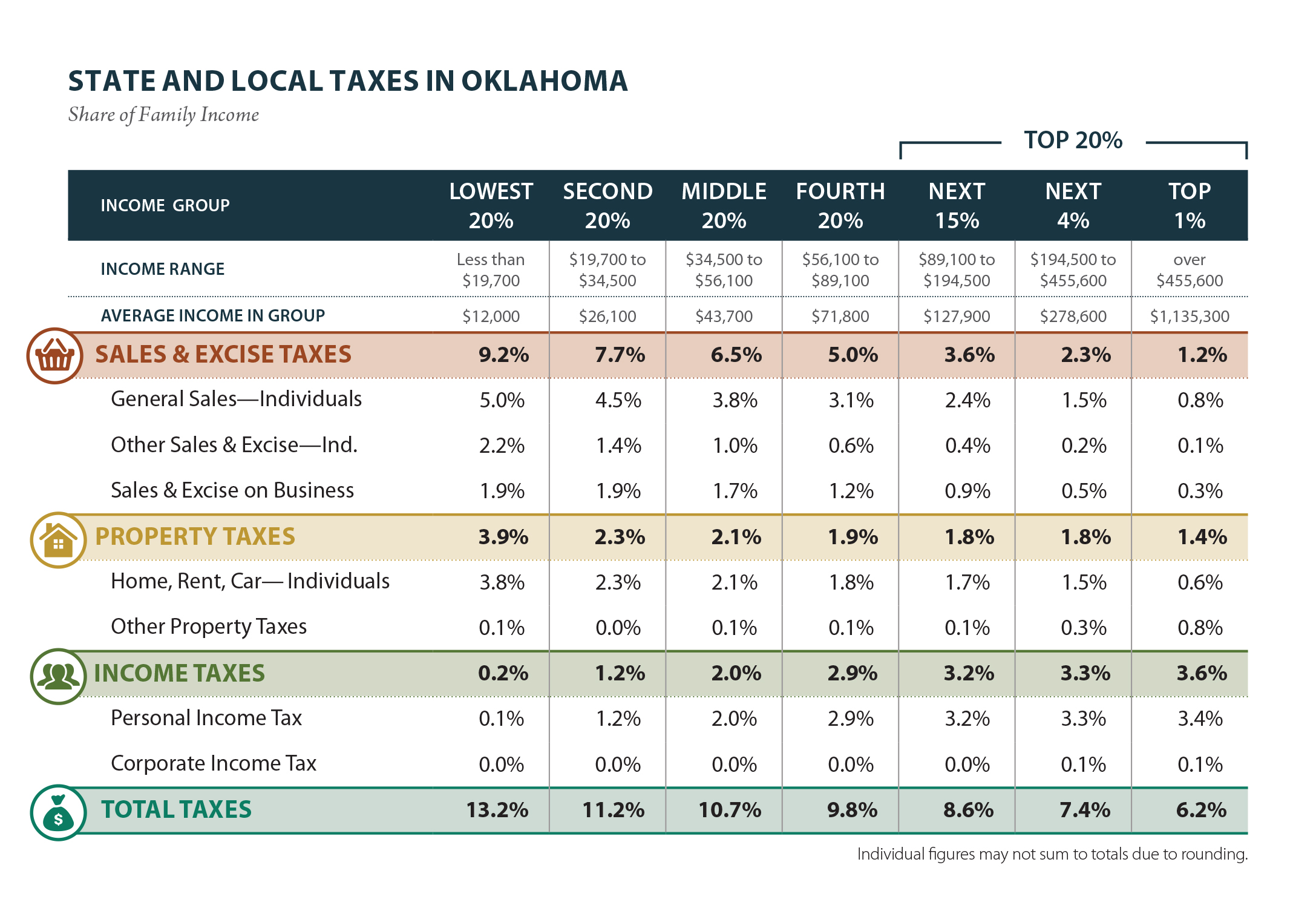

Oklahoma Who Pays 6th Edition Itep

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Should Oklahoma Broaden The Sales Tax To More Services Oklahoma Policy Institute

Oklahoma Sales Tax Small Business Guide Truic

The Tulsa County Oklahoma Local Sales Tax Rate Is A Minimum Of 4 867

Florida Sales Tax For Nonresident Car Purchases 2020

Local Tax Information City Of Enid Oklahoma

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

A Complete Guide On Car Sales Tax By State Shift

Oklahoma Who Pays 6th Edition Itep

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma Who Pays 6th Edition Itep

How To Calculate Sales Tax How To Find Out How Much Sales Tax Sales Tax Calculation Youtube